Portfolio Management Services (PMS) are an investment portfolio in stocks/fixed income/debt/cash/ structured products managed under professional management. When you invest in PMS, you own individual securities unlike a mutual fund investor, who buys and owns units of the fund. You will have the flexibility to tailor your portfolio to address personal financial goals. Although the portfolio managers may manage hundreds of portfolios, each PMS account may be unique. The minimum ticket size for a fresh investment in PMS solutions is 50 lakhs as per SEBI guidelines.

Please find a selection of top performing PMS funds. Please connect with us to know more,

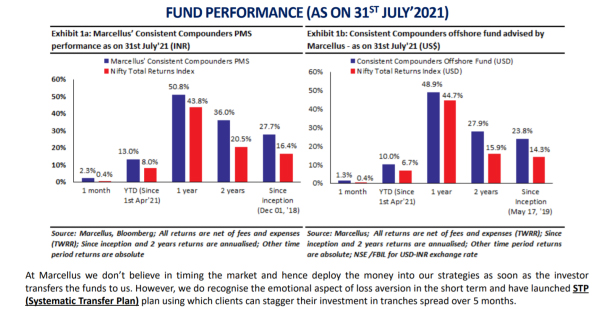

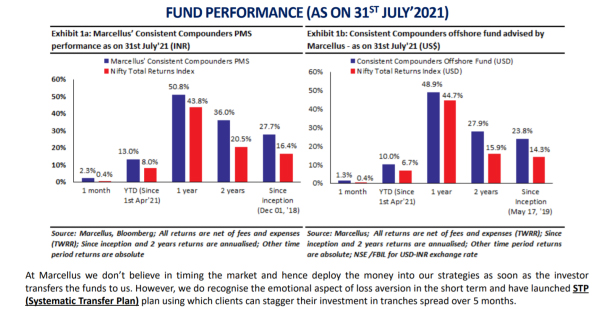

Marcellus Consistent Compounders PMS

Marcellus’ Consistent Compounders PMS invests in a concentrated portfolio of heavily moated companies that can drive healthy earnings growth over long periods of time. Portfolio construction involves a two-stage process:

- A filter-based approach to create an investible universe of 25-30 stocks

- 2.In-depth bottom-up research of such companies in the universe to assess sustainable competitive moats to build a portfolio of 10-15 stocks that deliver healthy compounded earnings growth over long periods of time.

While the filters are applied annually, companies in the portfolio and in the coverage universe are monitored for sustainability of moats on a continuous basis through extensive primary and secondary research.

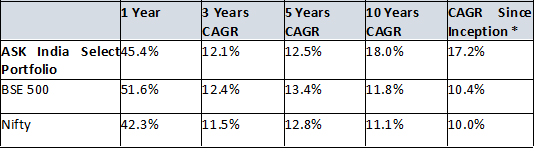

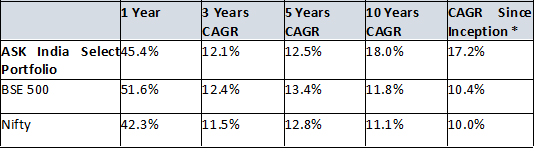

ASK India Select PMS

ASK India Select PMS

ASK India Select is a best ideas portfolio representing all the key value-creating attributes. The portfolio represents an eclectic mix of:

- Size of opportunity

- Earnings growth

- Quality of the business

- Price-value gap

* Inception Date: 4th January 2010

Note:

* Inception Date: 4th January 2010

Note: Performance figures are net of all fees and expenses.

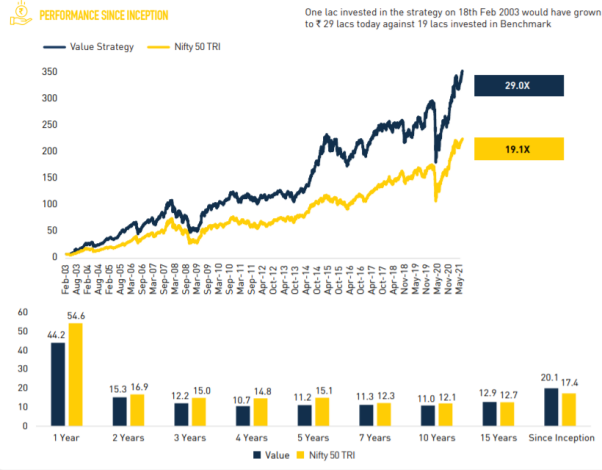

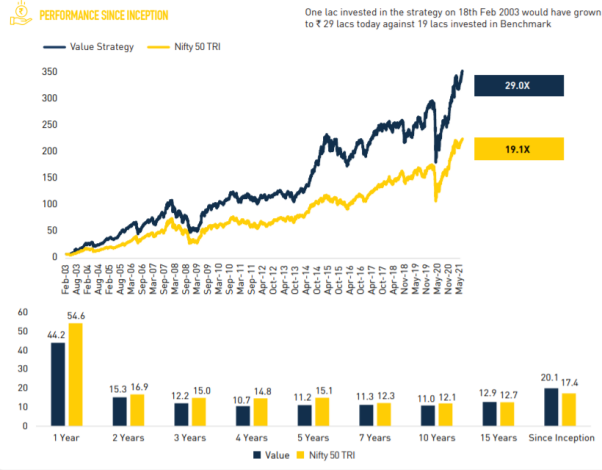

Motilal Oswal Value Strategy

Investment Objective: The Strategy aims to benefit from the long term compounding effect on investments done in good businesses, run by great business managers for superior wealth creation.

Description of types of securities: Listed Equity Basis of selection of such types of securities as part of the investment approach: value based stock selection strategy

Allocation of portfolio across types of securities: The strategy seeks to primarily invest in Equity and Equity-related instruments of large cap companies. However, the strategy has the flexibility to invest in companies across the entire market capitalization spectrum

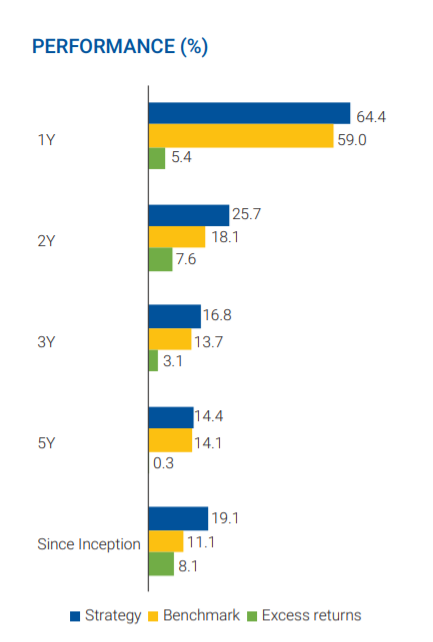

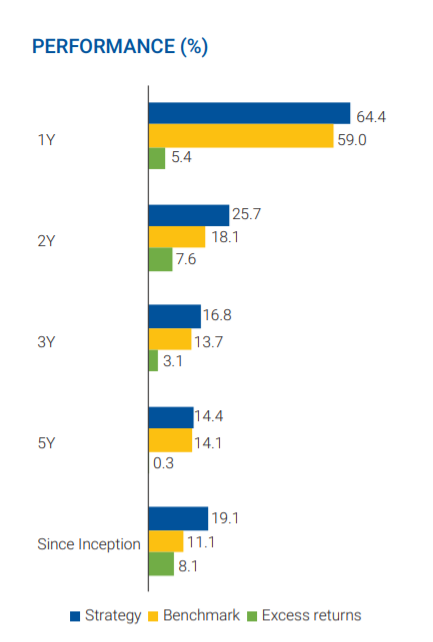

Sundaram India Secular Opportunities Portfolio

Sundaram India Secular Opportunities Portfolio

Objective: To generate capital appreciation across market cycles by investing in a concentrated set of high conviction stocks.

Target Investors: Designed for investors seeking returns through investments in a concentrated portfolio of companies with sustainable competitive advantages and reasonable valuations.

Sundaram Emerging Leadership Fund (S.E.L.F.) Portfolio

Sundaram Emerging Leadership Fund (S.E.L.F.) Portfolio

Objective: To seek long-term capital appreciation with investments in mid and small cap companies.

Target Investors: Ideal for long-term investors seeking returns through investments predominantly in small and midcap stocks and are comfortable with short-term volatility.