Latest articles on Life Insurance, Non-life Insurance, Mutual Funds, Bonds, Small Saving Schemes and Personal Finance to help you make well-informed money decisions.

Should an active mutual fund invest in a passive one? Given that both these fund types are diametrically opposite, if an active fund chooses to hold in its portfolio, among other carefully researched stocks, units of a passive fund, it seems like a misfit.

When you hand your money to a fund manager for “active” management, you are targeting a return that is above the benchmark. For a benchmark return, you are better off in a passive fund like an exchange-traded fund (ETF) that has a much lower cost than an active fund does.

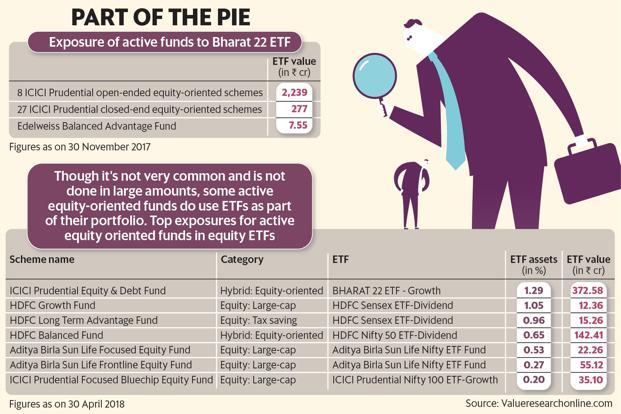

A recent blog post pointed out its author’s displeasure with portfolios of various ICICI Prudential Asset Management Co.’s equity-oriented funds buying into the Bharat 22 ETF, launched in November 2017. Data from Valueresearchonline.com shows, at the end of November 2017, the aggregate exposure of various open-ended and closed-end equity-oriented funds managed by the AMC was around ₹2,500 crore in Bharat 22 ETF. Five months later, as on end April 2018, only one of the funds had exposure to the Bharat 22 ETF. There are other examples of funds investing in ETFs, albeit not in large quantities as seen in ICICI AMC’s case. But what promoted this relatively large investment in an ETF for ICICI equity funds? Was this brief holding just a tactical strategy?

In November 2017, the government launched Bharat 22 ETF as part of its economic reform and disinvestment program, and ICICI AMC was chosen to create and manage the same. The ETF received applications worth around ₹32,000 crore and shares worth ₹14,500 crore were allotted, according to a government release. We spoke to experts to find out why active equity funds might buy equity ETFs in their portfolio and if it is a viable strategy.

The lure of a passive fund

At least 35 different equity-oriented funds managed by ICICI AMC held units of Bharat 22 ETF after its launch for 2-3 months.

According to Raghav Iyengar, head of retail and institutional business, ICICI AMC, “Bharat 22 ETF managed by ICICI AMC is a basket of diversified, good quality, large-cap, liquid stocks with a good dividend yield and long-term earnings prospects. During the new fund offer period of Bharat 22 ETF, a 3% discount was offered which created a good investment opportunity.”

While it is common to see asset allocation funds investing in gold ETFs or even equity ETFs based on broad market indices, it is still not common for actively managed equity funds adding ETFs. “The merit of investing in an ETF is that it allows you to take exposure to a number of stocks if one is bullish on the constituents of the ETF. In case of Bharat 22 ETF, the investment made provided reasonable return in a short span of time,” said Raghav.

Not a widely used strategy, but there could be a couple of reasons for active funds to invest in ETFs. For example, a smart beta index-based ETF might present an investment case which can tactically compliment an actively managed fund. Another example could be during a sudden and sharp fall in the market due to an unrelated event, an active fund finds it opportunistic to take advantage of the fall via exposure to a broad market index-based ETF. However, not all are convinced that such strategies work.

According to Himanshu Srivastava, senior research analyst, Morningstar India, “Although active funds are not restricted from buying into passive funds, we prefer they stay away from them. We have seen many instances of active equity funds investing short-term cash surpluses in say liquid or ultra short-term funds from their own fund house; it is rare to see them buy into an equity ETF. One has to weigh the opportunity lost in making that allocation instead to an active stock selected based on research.”

According to Radhika Gupta, chief executive officer, Edelweiss Asset Management Ltd, “An ETF is a cost-effective way to take an exposure to a defined set. The Bharat 22 ETF came at a discount, which presented an arbitrage opportunity in our Balanced Advantage Fund where taking such positions is part of the strategy. Ideally, active fund managers have a clear mandate to select stocks and an ETF doesn’t fit in there. Even smart beta ETFs may actually conflict with the stock selection in an active fund.”

Does it impact investors?

While there is no additional cost involved in such allocations to passive funds, investors are justified in questioning the strategy.

“There are questions that arise; is it part of a regular strategy to make opportunistic investments through ETFs? Also, if a scheme is doing this, is it pre-dominantly in an ETF from their own stable or would this be the case from ETFs launched by other fund houses too? Moreover, one has to understand if the tactical strategy fits in with the overall objective of the fund,” said Srivastava.

For example, a small-cap fund with a high exposure to say, a large-cap index-based ETF might raise eyebrows. However, it’s possible that the exposure is within the limit needed to maintain appropriate liquidity in the fund.

While some investors prefer true-to-label funds which don’t waver at all from the stated investment objective, others may not be perturbed with some opportunistic deviations in small proportions if the overall theme and risk levels remain the same.

An active fund is not disallowed to buy passive funds, nevertheless this is a departure from its fundamental strategy. An investor can rightfully question and demand to understand the reason behind it. Stay invested only if you agree with the approach and process.

Copyright © 2025 Design and developed by Fintso. All Rights Reserved